Real Estate Property Committing For Novices

Real-estate expense can be an outstanding approach to increase your revenue stream, but before plunging in it's essential to carefully take into account several aspects including education, time, connections and self confidence.

Include real-estate purchases for your investment profile for many pros. They could diversify and reduce dangers.

Getting a Home

First-timers in real estate committing should grow to be knowledgeable about their possibilities and also the different strategies for starting up. There are several kinds of real estate expense opportunities, such as acquiring or leasing attributes as well as making an investment in REITs each and every may need much more job based on its complexness, but all are good ways to start real estate property expense.House acquiring for property investment is one of the simplest and the majority of effective tactics accessible to property buyers. By searching out properties suitable for remodelling within your geographic area at the best prices, buying them and renovating them quickly you can get into real estate property expense without experiencing massive down monthly payments or maintenance expenses. When you are evaluating attributes to get it's also smart to think about your target audience: for instance focusing on houses near excellent college areas or parks can help filter your concentration significantly.

Turnkey lease qualities supply another methods of making an investment in property. These solitary-loved ones and multifamily houses have already been refurbished by a good investment property firm and so are ready for rental, which makes this type of real-estate acquire well suited for novices without the resources to remodel qualities their selves.

Real estate property investing for beginners offers many desirable positive aspects, one particular becoming its capability to create cash flow. This means the web earnings after home loan repayments and working expenditures have already been subtracted - it will also help include home loan payments although decreasing taxes due.

REITs and crowdfunding offer you two feasible purchase alternatives for newbies planning to enter in real-estate, correspondingly. REITs are property expense trusts (REITs) dealt on carry exchanges that very own and deal with real-estate properties these REITs provide a secure way of diversifying your stock portfolio when and helps to fulfill financial desired goals more quickly than other forms of committing. Moreover, their prices are available for relatively moderate sums of capital making REITs an ideal strategy to begin making an investment for starters.

Purchasing a Industrial House

When selecting professional house, investors should understand that this kind of expense can vary drastically from buying residential real estate property. When choosing your location wholesaling houses for dummies and taking into consideration the risk patience and function for committing, neighborhood zoning laws and regulations must also be evaluated as an illustration if making use of it for organization take advantage of this can impact reselling ideals in addition to rental prospective.As opposed to home real estate investments, investing in industrial attributes requires greater threats and needs extensive research. They are certainly more sophisticated with increased cash flow requirements in comparison with one-loved ones homes in addition, there may be a variety of charges for example personal loan expenses, property income taxes, premiums, maintenance estimates, administration costs or maintenance estimates - these costs can easily mount up it is therefore truly essential that the expert evaluates what is wholesaling the current market prior to investing.

Commencing your job in industrial home entails utilizing the skills of an knowledgeable brokerage or real estate agent. They are going to help in getting you with a residence that finest meets your needs and spending budget, and assist with due diligence procedures when necessary. Before getting a house it is also necessary to fully grasp its community taxation law effects along with knowing how to estimate limit amount and cash flow computations.

There are six main methods of investing in real-estate: direct expenditure, REITs, REIGs, real-estate syndication and crowdfunding. Every approach to real estate property investment possesses its own group of positive aspects and difficulties when picking one you must also make a decision if you plan to purchase/flick/manage/outsource the work.

As a novice in actual residence shelling out, a smart approach may be to start out through the use of existing home equity as make use of. This process will save you both time and expense because it removes the irritation of getting discounts yourself when supplying you with being exposed to sector criteria prior to buying your own attributes.

Getting a Lease Residence

One of the best real-estate making an investment strategies for beginners is getting lease properties. Renting out house gives a very good way to build passive income when potentially turning into extremely lucrative nonetheless, newcomers should understand that getting rental property can be risky venture. They must conduct a in depth market and location analysis before making any ultimate judgements for example they ought to look at factors like crime charges, college zones and saturation of products inventory within their place simply because this will permit them to prevent burning off funds or overpaying for components.First-timers in actual residence investment should search for more compact, safer ventures like a beginning point, such as getting a individual-loved ones house or condo in a safe local community. They should try to find qualities with possibility of long-term growth to grow their expenditure portfolio gradually after a while.

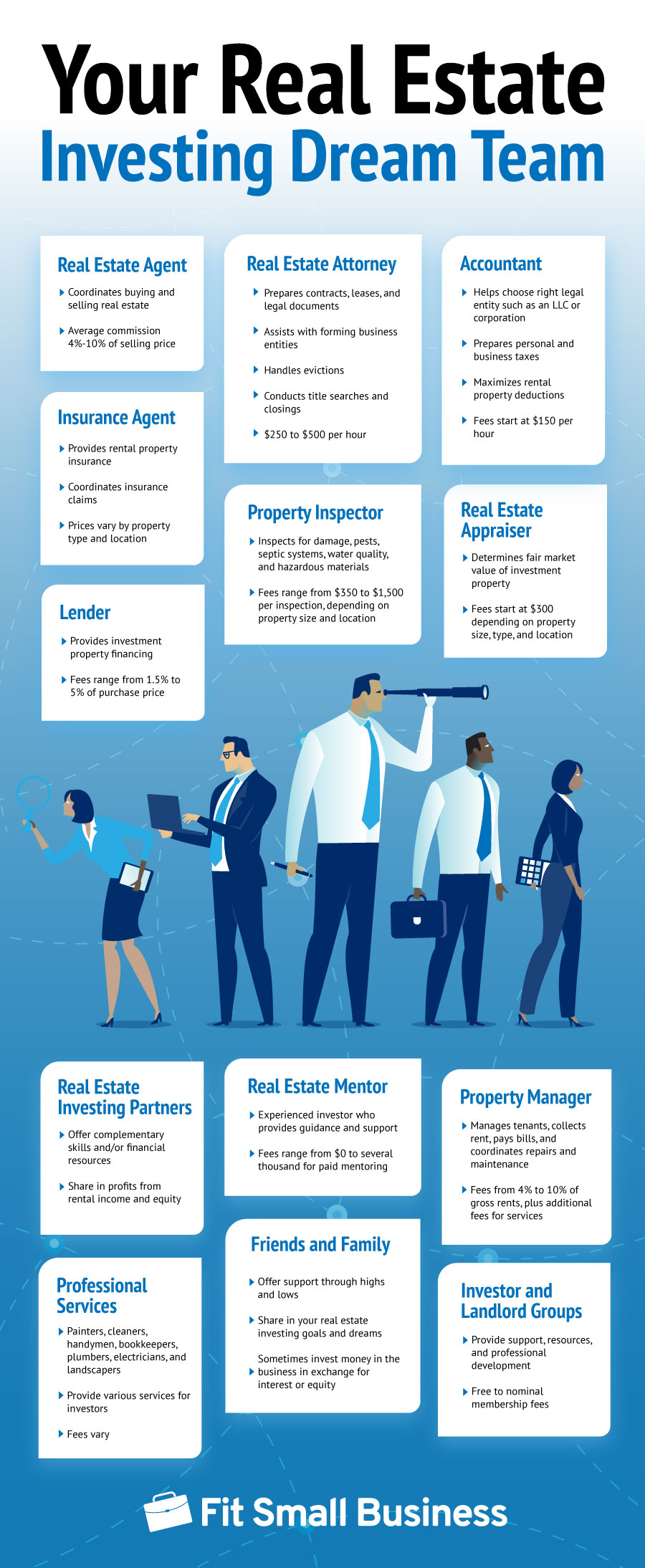

Keep in mind that real-estate ventures need both effort and time to ensure that you control. As this can be difficult for beginning traders, it is truly essential they may have use of a help group comprising residence administrators, legal professionals, accountants, companies, and many others. Furthermore, newcomers should attend as numerous marketing events as you possibly can to fulfill other industry experts in their business and look for their niche market.

Ultimately, possessing a detailed policy for each and every property you hold is key. Accomplishing this will enable you to monitor funds inflow and outflow relevant to renting in addition to when it may be useful to remodel or upgrade them - ultimately supporting maximize your return on your investment.

Real estate can seem like a daunting struggle, but its advantages may be substantial. Not only can real-estate offer you steady streams of income but it is also an excellent diversifier to your retirement living bank account, lowering chance by diversifying clear of stocks that accident whilst often pricing lower than other long term assets.

Purchasing a REIT

REITs supply buyers use of real estate property without needing to obtain person properties, whilst supplying better results in than traditional set earnings assets for example connections. They are often an effective way to broaden a profile nonetheless, brokers must ensure they fully understand any associated hazards and select REITs with founded keep track of information.There are numerous sorts of REITs, every single making use of their personal pair of distinctive qualities. Some concentrate on home loan-backed securities which might be highly unpredictable other individuals individual and control commercial real-estate including places of work or shopping malls still others personal multiple-family lease apartments and constructed real estate. A number of REITs are even publicly dealt on supply swaps enabling traders to directly buy offers other nonpublicly dealt REITs may only be accessible through private value cash and brokers.

When selecting a REIT, guarantee it provides a environmentally friendly dividend that aligns using its revenue background and control group. Also take into account the health risks included such as feasible house value fall and monthly interest changes along with its overall give back and every quarter dividends along with its once-a-year functioning revenue.

REITs typically spread dividends as common earnings instead of money profits with their investors, which might demonstrate helpful for anyone in lower tax brackets. It's also really worth remembering that REITs may offer much better opportunities than straight property shelling out for newcomers to property committing.

NerdWallet will help you pick an REIT ideal to the purchase requires by looking at brokerages and robo-analysts on-line, taking into account charges and minimums, expense alternatives, support service functionality and mobile phone app features. Once you find 1 you want, REIT buys may start bare in mind they're long-term ventures which require checking periodically additionally mortgage REIT prices often go up with soaring interest rates this trend tends to make home loan REITs especially erratic assets.