Buying Real Estate Property For Novices

Property purchase has long been accepted as an established technique for constructing wealth, but beginners could find it overwhelming to understand its difficulties and generate sustained earnings.

First-timers looking to get to their economic desired goals can investigate newbie-pleasant shelling out tactics using our guidance, tips and terminology to acquire them underway.

1. Real Estate Property Expenditure Trusts (REITs)

REITs provide investors a different method for purchasing property without having our prime set up funds needed to acquire home directly, with decrease first assets than straight getting real estate immediately. REITs what is wholesaling real estate are companies that individual, function or fund revenue-creating real estate property across a variety of industries - typically publicly exchanged - supplying investors with diverse real-estate belongings at decrease lowest expense quantities than acquiring individual qualities straight. Traders can make either value REITs which personal actual real estate property immediately themselves mortgage REITs which keep personal loans on real estate property or hybrid REITs which spend both varieties.REITs can offer your collection with diversification benefits as they have decrease correlations to stocks and bonds than their standard brethren, however they're not economic downturn-proof it is therefore best if you consult your monetary advisor concerning the amount of your collection needs to be purchased REITs based on your danger tolerance and goals.

These REITs give brokers the chance to income through benefits that are taxed as carry dividends, but investors should be aware that REIT benefits can be influenced by factors like altering rates and changes in the real estate market place.

Dependent upon the sort of REIT you pick out, it is essential that you analysis its monetary history and recent efficiency using SEC's EDGAR program. Well before making a decision to acquire or promote REIT reveals, check with a licensed broker or economic advisor that can offer you updated market intelligence and guide an educated decision - using this method making certain you're acquiring optimal returns on your own ventures.

2. Property Investment Organizations (REIGs)

As a rookie to property making an investment, the experience might be both expensive and intimidating. By enrolling in a REIG you have an possibility to pool both money and time with other investors in order to reap returns easily with small job needed of your stuff. REIGs is available both locally or over a national range and work differently some charge registration charges while some don't also, diverse REIGs call for distinct quantities of associate contribution with many possessing one organizer who manages every thing while other may work far more as partnerships.No matter what REIG you select, it can be very important to perform considerable study well before making an investment. This can entail conducting interview and asking questions of organization staff in addition to examining past earnings. You real estate wholesaling step by step need to evaluation what purchase technique your REIG pursues - are they centered on flipping components swiftly or are they considering long-term cash flow age group through hire house ownership?

As with any type of expenditure, REIGs may either gain or cause harm to you financially to find one perfect in your exclusive financial situation and chance tolerance is crucial.

If you're curious about signing up for a REIG, start off your pursuit on the internet or via affiliate off their investors or skilled professionals. Once you discover a beautiful team, remember to talk with its organizer and fully grasp their set goals and dangers and also capitalization rate (also called "limit") in position - this ratio aids determine purchase house ideals and must play a vital role when you make decisions about enrolling in or making an REIG.

3. Real-estate Syndication

Real estate syndications enable brokers to get exposure to the market without having to be troubled with house growth and administration obligations by using an on-going foundation. Real estate property syndications requires an LLC composition composed of an active recruit who takes care of investment capital increasing, investment, enterprise preparing for particular assets indirect brokers acquire distributions in accordance with a waterfall construction with original investment capital contributions becoming distributed back and later on spread according to an ideal come back objective (such as 7Percent interior price of give back (IRR).Traders also enjoy taxes positive aspects included in the purchase package deal. Annually, they are supplied a Timetable K-1 showing their revenue and loss for the syndication, in addition to devaluation write offs due to expense segregation and quicker devaluation of residence.

Expense trusts might be perfect for novices because of their reduced measure of risk in contrast to straight house buys. But take into account that danger degrees rely on every situation based upon factors such as the neighborhood market, house kind and strategic business plan.

To create a knowledgeable decision about investing in property syndications, it's necessary that you conduct homework. What this means is reviewing trader resources including project executive summaries, whole investment overviews, entrepreneur webinars and sponsor team monitor documents. When completely ready, arrange your place from the deal by signing and reviewing its PPM verify certification position before wiring funds to their balances.

4. Property Flipping

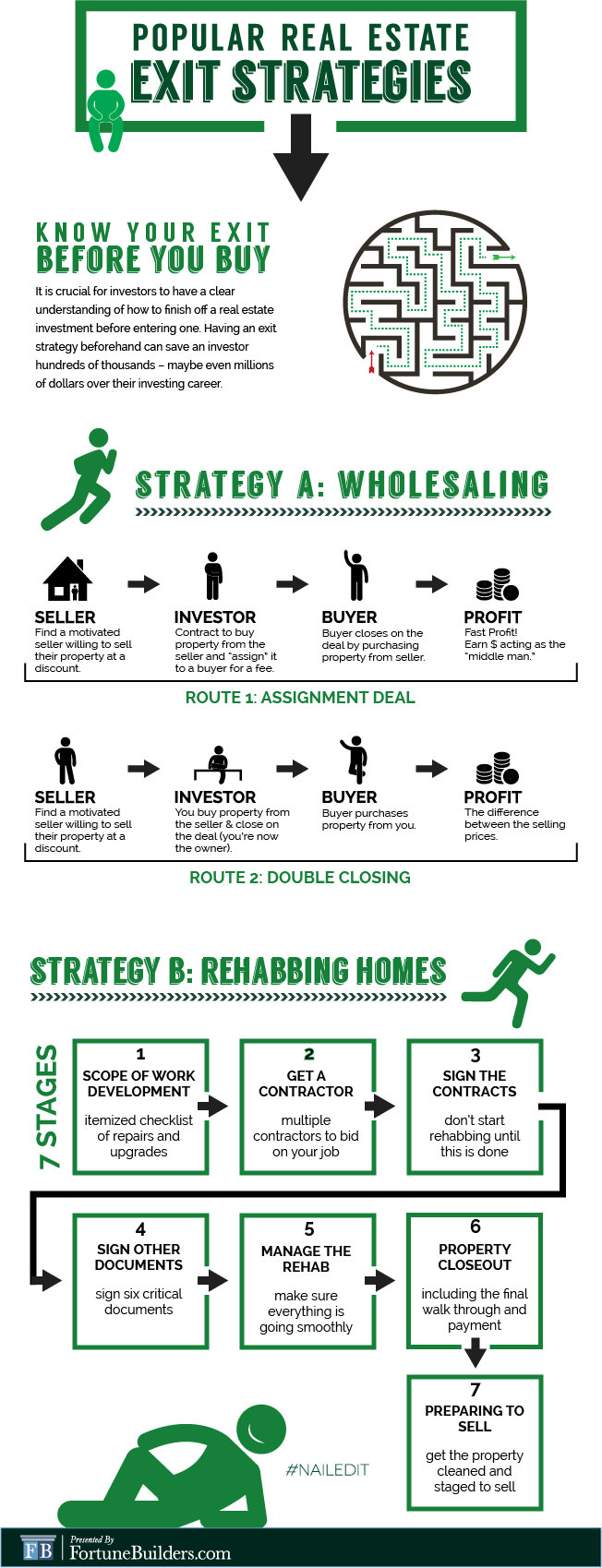

House flipping is definitely an outstanding means for newbie property buyers to transform a return by buying reduced and selling higher. Although this task usually takes lots of time and function, if done properly it could demonstrate highly lucrative. Getting properties with solid potential profit in regions folks want to stay is key here additionally enough money also must be set aside so that you can comprehensive renovation of stated home.For that reason, using a obvious business strategy is very important for figuring out your goals and devising an measures plan to accomplish them. Additionally, getting one serves as a good instrument when searching for buyers business plan templates on the net may aid in developing one quickly.

Beginning modest can help you ease into this type of purchase a lot more smoothly, and will enable you to fully familiarize yourself with its particulars quicker. A powerful help system - such as companies, plumbing technicians, electricians and so forth. will be important.

Rookie real estate property investors could also consider REITs, that are companies that own and manage numerous attributes like hospitals, manufacturing facilities, shopping malls, and home structures. Given that they business publicly about the inventory change they create them available for newbies.

Real estate committing can be highly fulfilling should you the research and try these tips. With so many options, there has to be one ideal for you - but be skeptical not to overextend yourself financially prior to being prepared or maybe it can lead to debts that can not be repaid.

5. Property Hacking

Home hacking is surely an procedure for real estate that requires getting and then renting back a area of the purchased house to renters, offering novices having an best method to go into the sector without shelling out too much in advance. Regular monthly lease income should include mortgage repayments so it helps quickly construct home equity.Property hacking also provide a great opportunity to fully familiarize yourself with becoming a landlord, as you will offer immediately with renters. Nevertheless, be mindful that house hacking is an unpredictable purchase technique sometimes hire earnings won't protect mortgage payments entirely on a monthly basis. Well before scuba diving in headfirst with this making an investment technique it is important that substantial consumer research be conducted.

Residence hacking delivers another advantage by supporting minimize or perhaps eliminate real estate costs entirely. For example, buying a multifamily home which has added models you can rent could make residing in it less expensive when another person compensates your mortgage payments specifically.

Home hacking calls for residing in the property you rent for that reason it is essential that you like residing there long term and feel relaxed inside your surroundings. Additionally, it's necessary that you think of how much operate booking out one or more models at home will need, including evaluating possible renters, getting rent repayments and dealing with renter issues.